First, meet the person to determine if they are a good fit for you. A meeting with your financial advisor will give you a chance to learn more about their professional background, fees, and experience. In your first meeting, you can ask 8 questions of a financial advisor. These questions will help you decide if this person is right to you. A qualified financial advisor will also be able to give you advice on what your financial future should look like.

8 questions to ask a financial adviser at your first meeting

Make sure you are clear about what to expect from your first meeting with a financial planner. Make sure you ask questions to clarify your needs and determine which criteria are most important for you. This will help you create a list with questions to ask your financial advisor. Do a quick assessment of the advisor after you have met with them. You should check, for example, if the advisor has been registered with the state.

Your spending habits should be clear to your financial advisor. This will give them an idea of how to best help you reach your goals and manage your finances. Some people are extremely careful savers, others spend extravagantly. Ask your advisor about your household budget. Ask them about your household budget and they should be able tell you why. Finally, get to know the advisor's personality and style.

Career experience

A financial advisor should have excellent communication skills and be able understand the clients' goals. They must also be proficient in spreadsheet software and have strong analytical and computer skills. The best preparation for a career working as a financial advisor is a degree in finance, law or business. Certain financial firms require new graduates with a GPA to be hired. An advisor in financial services must be able to complete continuing education every year after they have been hired.

Financial advisors often require a bachelor’s degree. Many professionals get into the industry working in investment firms. You can get certifications and advanced degrees through internships. But, it is possible to also enter this field via another route. During an internship, a financial advisor may research investments and update a client's financial plan. They can either start their own business or join a company that has an existing one.

Fees

It's important that you understand the costs of a financial adviser. Many advisors charge hundreds of thousands of dollar and may not disclose other income sources such as percentages, commissions, or payouts. You may be tempted by them to sell you products that do not suit your best interests. In such a situation, you should insist on fee transparency from the start. The following questions will help you decide if the advisor's fee structure is appropriate for your needs.

The fees that you pay will impact the amount of advice you receive. Some advisors charge a lower fee or have lower charges. Before you decide to hire a financial advisor, it is crucial to know what their costs are. As you are paying them to help create a financial strategy, you don't want a poor investment outcome.

FAQ

What happens when the consultant finishes his job?

After the consultant finishes the work, s/he will send a final report outlining the results. This report will include project timelines and deliverables as well as any other relevant information.

After that, you'll go through the report and decide if it meets your expectations. If not, you can either request changes or terminate the contract.

Why would a company pay a consultant?

Consulting provides expert advice about how to improve your business performance. They aren't there to sell your products.

Consulting helps companies make better decisions. They provide sound analysis and offer suggestions for improvement.

Consultants often work closely with senior management teams to help them understand what they need to do to succeed.

They also offer leadership training and coaching to ensure that employees are able to perform at their best.

They can help businesses reduce costs, streamline processes, and increase efficiency.

How is consulting different from freelancing

Freelancers can be self-employed people who provide their services to clients, without the involvement of employees. They charge hourly rates depending on the amount of time spent on a client's projects. Consultants work for companies and agencies that employ them. They are often paid monthly or annually.

Consultants often have more flexibility, while freelancers can choose to work when they want and set their own rates. Consultants, however, often have better benefits such as retirement plans, vacation days, and health insurance.

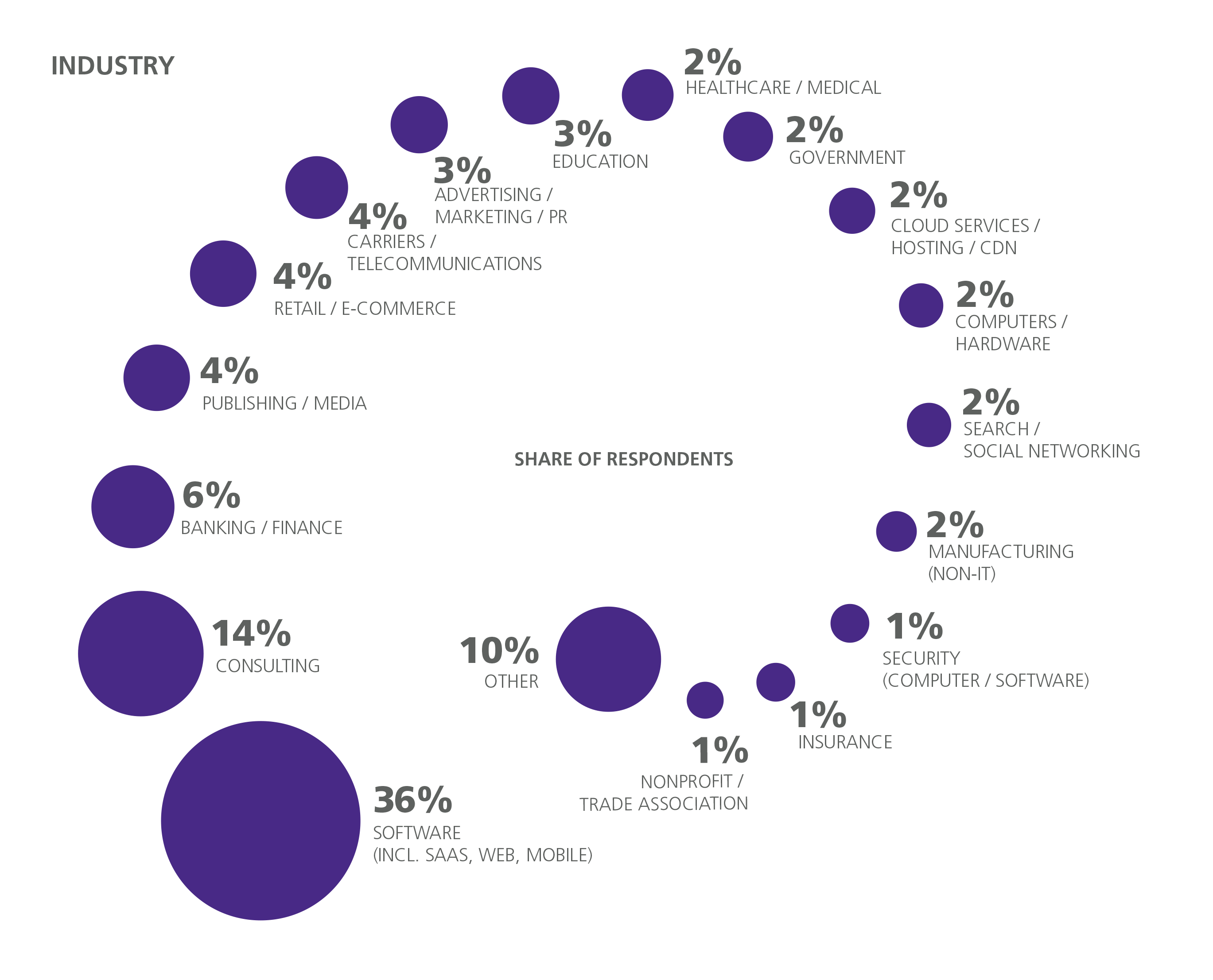

Statistics

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

External Links

How To

How to start a consulting company and what should I do first?

It's a great way for you to make money online by starting a consulting company. No prior business experience is required. A good place to start your own consulting company is to build a website. Once you have a website built, you can start using social media platforms such Instagram and Pinterest to spread the word about you services.

These tools will allow you to create a marketing plan which includes:

-

Creating content (blogs)

-

Building relationships (contacts).

-

Generating leads through lead generation forms

-

Selling products via ecommerce websites

Once you've developed your marketing strategy, you'll need to find clients who will pay for your services. While some prefer to network through events and networking groups, others prefer to use online tools like Craigslist or Kijiji. It's up to you to make the decision.

After you have found new clients, it's important to discuss terms and payment options. This could include hourly fees, retainer agreements, flat fee contracts, etc. It's important to know what you expect before accepting a client so you can communicate clearly throughout the process.

Hourly agreements are the most common contract type for consultancy services. This contract allows you to pay a fixed amount each week or month for certain services. You might be able, depending on which service you offer, to negotiate a discount. You must fully understand the contract you're signing before you agree to it.

Next, create invoices for your clients and send them. Invoicing can be a complicated task until you actually attempt it. You have many options to invoice your clients. For example, some people prefer to have their invoices emailed directly to their clients, while others print hard copies and mail them. No matter what method you use, ensure it works for your business!

After creating invoices are complete, you will need to collect payments. PayPal is popular because it is easy to use, offers several payment options, and most people prefer it. Other payment processors such as Square Cash. Google Wallet. Apple Pay. Venmo.

Once you are ready to start collecting payments, it is time to open bank accounts. Separate savings and checking accounts will allow you to track your income and expenses independently. It is also a good idea to set up automatic transfers into your bank account for paying bills.

Although it can seem daunting when you first start a business as a consultant, once you get the hang of it, it will become second nature. For more information on starting a consultancy business, check out our blog post here.

A consulting business is a great way of making extra money without worrying about your employees. Consultants can work remotely so they don't have the hassle of dealing with office politics and long working hours. You have more flexibility than traditional employees because you aren't tied down by work hours.