Creative Money LLC offers professional financial planning services for the Seattle area. Their team consists of highly trained professionals who are passionate about helping their clients achieve financial independence. Mindy Crary is the founder of the company. She has a master's degree in business administration and over 20 years experience in the financial sector. She also holds professional certifications in coaching.

Advice only from financial advisors

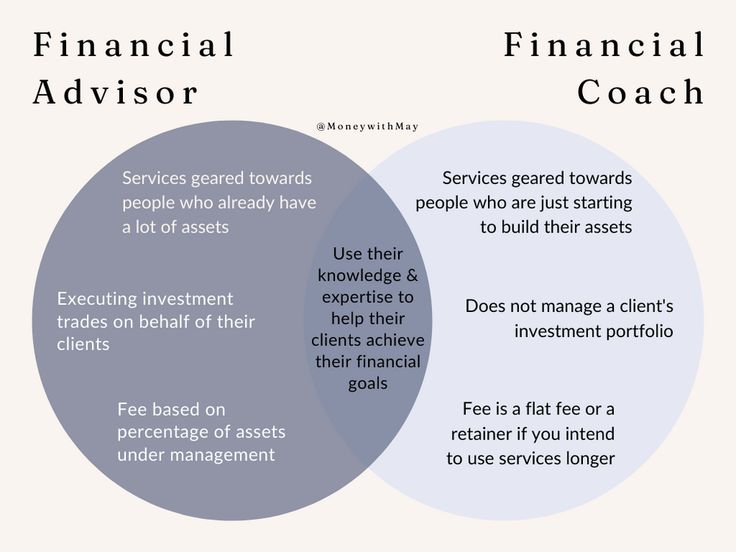

Only advice-only financial advisors can offer financial planning in Seattle. They offer advice and make suggestions to clients about their portfolio investments, but they don't push them into making specific investments. These advisors can provide valuable information on investment opportunities and offer advice. Many clients are still skeptical about the services these financial advisors provide.

It is a great idea to hire a financial advisor in order to develop a long-term investment plan. A financial advisor can help you create an investment portfolio that will help reach your financial goals. Moreover, a financial advisor with local roots will be familiar with the economy of the Seattle region, including the costs of living and the employers in the area.

Financial advisors who charge a fee

There are two types Seattle financial advisors: fee-based and fee only. The fee-only advisor receives no compensation from clients. This contrasts with a fee-based financial adviser, who is compensated only by fees from their clients. This creates an inherent conflict in the interests. A fee-only financial adviser is also required by law to act in the best interests their clients.

A fee-based financial advisor will charge a fee that varies from client to client. A fee for services varies from $600,00 to $1 million, but it is usually based on the client's net worth. Many fee-based advisers in Seattle offer complete wealth management strategies. Fee-based advisors in Seattle can help with portfolio management as well as tax planning, estate planning and retirement planning.

Wealth management firms

Wealth management firms in Seattle provide a range of services that include financial planning and investment management. They help individuals, companies, and pension and profit sharing plans achieve their financial goals. They can provide customized investment and financial management strategies that fit each client's specific financial needs.

Miller Advisors is one of the most reputable wealth management firms in Seattle. This independent wealth management firm charges a fee. This firm provides comprehensive services including investment management, retirement planning, estate planning, and family business planning. The firm is made up of certified financial advisors, attorneys, estate planners, as well as estate planners. With a combined 50-years of experience, the team has extensive experience in helping families to manage their financial affairs.

The cost of working with a financial planner

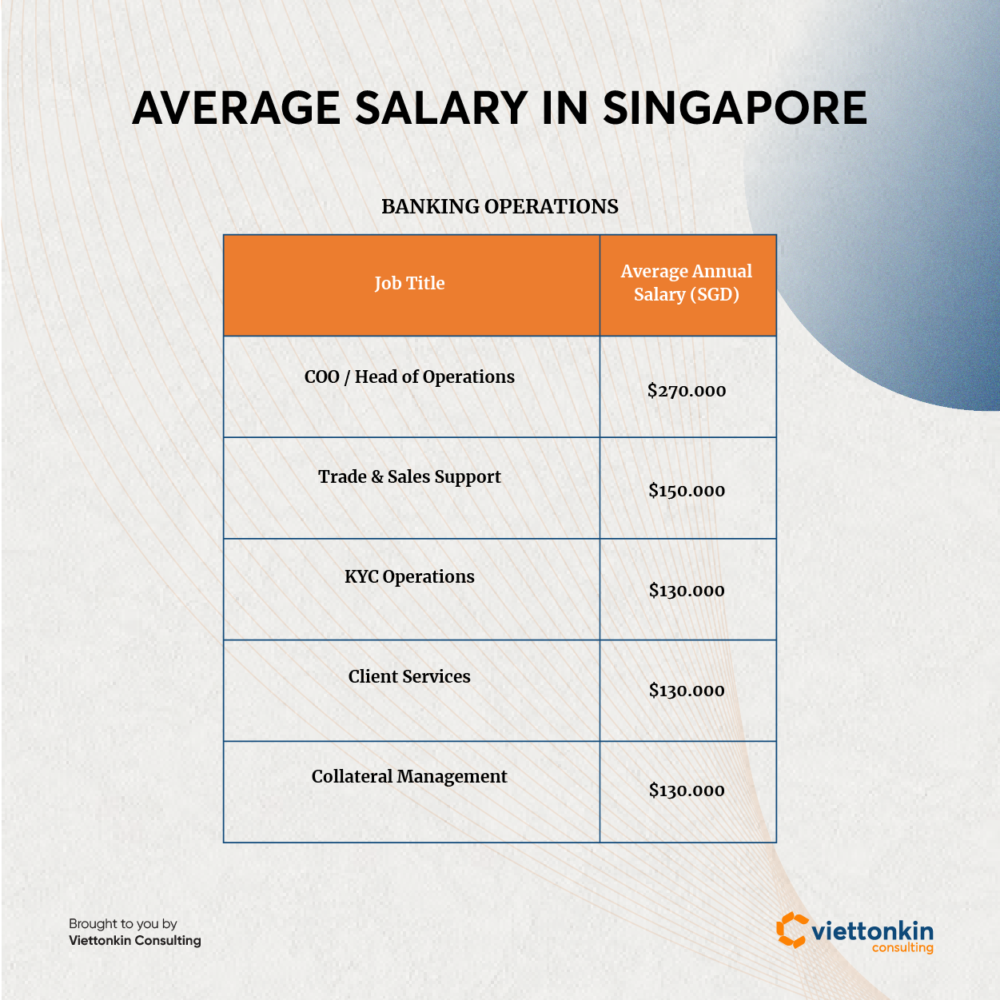

The fees that financial advisors charge vary depending on whether they offer an hourly or fixed rate. Some charge an annual fee of one percent of the AUM, while others charge by the hour. Asset management fees vary from about $230 an hr to as high as $7,500.

Before you hire an advisor it is important to be aware of the charges. Some advisors charge an hourly rate for certain services, which you may not need. There may also be a onetime fee charged for limited questions. A great financial advisor will strive to establish a long-lasting relationship with clients.

FAQ

Are consulting incomes subject to tax?

Yes, you must pay tax on the consultancy profits. The amount you earn depends on your annual income.

If you are self employed, you can claim expenses in addition to your salary. This includes rent and childcare.

You can't deduct the interest on loans, vehicle damage, or equipment costs.

Only 25% of your expenses can be claimed back if you make less than PS10,000 annually.

However, you might still have to pay tax if your earnings are higher than the threshold. This depends on whether you are an employee or contractor.

Pay as you Earn (PAYE) is the most common method of taxing employees. Contractors pay VAT.

What industries use consultants

There are many different types. Some consultants are focused on a specific type of business, others may specialize in multiple areas.

While some consultants only work for private companies, others represent large corporations.

Many consultants also work internationally to assist companies from all corners of the globe.

Is it possible for a consulting business to be run from home?

Absolutely! This is something that many consultants do already.

Many freelancers work remotely via tools such as Skype, Trello and Basecamp. They may even create their own office space in order to take advantage of company perks.

Some freelancers prefer to work in cafes or libraries instead of in a traditional office environment.

Some choose to work remotely because they are surrounded by their family.

While working remotely has its advantages, it also comes with some disadvantages. But if you love your job, it's definitely worth considering.

Statistics

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

External Links

How To

How To Find The Best Consultant?

The first thing to do when looking for a new consultant is to ask yourself what you want from him/her. Before you look for someone, you need to be clear about your expectations. Make a list of everything you think you might need from a consultant. This could include: professional expertise and technical skills, project management capabilities, communication skills, availability, etc. You might also want to talk with colleagues or friends about their recommendations. Ask your friends or colleagues about any negative experiences they have had with consultants, and compare their recommendations with yours. Do some internet research if they don't have recommendations. You can post reviews on your previous work experiences on many websites like LinkedIn, Facebook and Angie's List. Consider the ratings and comments of other candidates and use these data to start your search for potential candidates. Once you have a shortlist, be sure to contact potential candidates directly to schedule an interview. At the interview, it is important to discuss your requirements and get their feedback on how they can help. It doesn’t matter who recommended them to you, just make sure they understand what you are trying to achieve and how they can help.